Understanding Real Estate Market Cycles

The world of real estate is a dynamic and ever-evolving one. It’s a complex ecosystem influenced by various factors, from economic conditions to consumer sentiment and global events. The real estate market doesn’t move linearly, but rather in cycles, and understanding these cycles is crucial for anyone looking to make informed investment decisions. In this blog, we’ll discuss the cycles and what are the factors that affect the cycle in the real estate market.

The Real Estate Cycle Unveiled

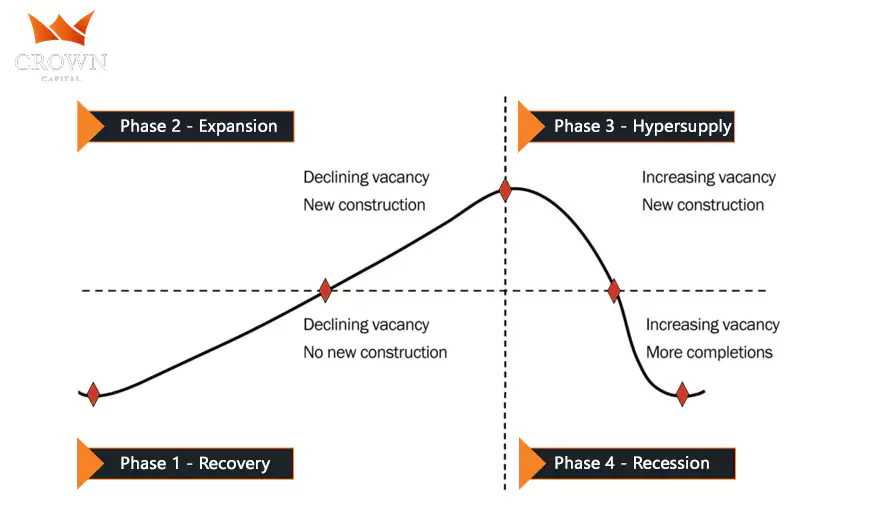

The concept of market cycles is nothing new; it has been a recurring pattern in real estate for centuries. The real estate market generally follows a sequence of four phases: recovery, expansion, hyper-supply, and recession.

Recovery

This marks the beginning of a new cycle. After a period of recession or downturn, the market slowly starts to recover. Prices stabilize or even decrease slightly, while demand begins to pick up. The recovery phase is marked by a high unemployment rate, low consumption, and stagnant rent growth along with no signs of new construction. However, this is a great time for investors to look for properties below market value that are distressed.

Expansion

As the recovery phase gains momentum, the market moves into expansion. Prices start rising, and demand surges. This is the time of vacancy decline along with both rents and occupancy tend to rise. The economy improves, and supply is improved with new construction due to which investors regain their faith which in turn increases the demand for the properties. This phase is beneficial for the investors to develop properties according to the current market’s demand and sell for more than market value.

Hyper-Supply

When the market reaches its peak, it enters the hyper-supply phase. Hyper supply is caused by the surge in prices but eventually, these prices will drop as demand weakens. To meet the demand, supply exceeds due to shifts in the economy or other factors. Thus, demand pulls back in this phase leading to hyper-supply.

As an investor, this is a great time to hold strong because property owners might keep the prices low due to fear that the property might go vacant or unsold. Therefore, it is a good time for investors to watch out for the deals that are profitable for them as negotiations with the property owners are an easy outlook in this phase.

Recession

Eventually, the market cools down, and the hyper-supply phase gives way to a recession. This is a period of falling prices, reduced demand, increased vacancy levels, and economic uncertainty where growth is slowed down. It can be a challenging time for investors, but it also presents opportunities to buy properties at a discount.

Investors with experience, proven track record, and capital can raise funds for investing. It is a golden chance for investors to acquire distressed properties at a deep discount and hold them for a period till they are ready to hit the market when the economy starts to recover.

Understanding these phases is pivotal for investors, as each phase offers unique opportunities and challenges. It’s crucial to adapt strategies based on the current phase of the market.

Navigating Real Estate Market Cycles

In 2023, the real estate market is in a transitional phase marked by uncertainty and a shift towards a more balanced landscape. Affordability challenges persist due to high mortgage rates and home prices, but there are predictions of a gradual decline in home prices, potentially improving affordability. Limited housing inventory remains a persistent challenge, and experts anticipate continued scarcity. Home prices are expected to see steady growth.

Investing in real estate successfully requires more than simply identifying the current phase of the market. It also involves adapting your investment strategy to align with the specific characteristics of each phase.

For example, during an expansion phase, it might be wise to seek out properties in areas with strong job growth and rising demand. In contrast, during a recession, the focus could shift towards acquiring distressed properties or rental units since more people tend to rent during uncertain economic times.

In addition to these strategies, diversification is a key component of weathering market cycles. Diversifying your real estate portfolio can help mitigate the impact of a downturn in one market while allowing you to benefit from growth in another.

Factors Influencing Real Estate Market Cycles

A multitude of factors influence the real estate market cycle. However, experts generally concur that the following factors play pivotal roles:

- Demographics- Population composition and significant shifts within it can exert a profound impact on the real estate market. For instance, the retirement of the baby boomer generation is expected to trigger substantial changes in the housing market as many opt to downsize or relocate to vacation destinations.

- Interest Rates- The fluctuation of interest rates wields considerable influence over the purchasing power of potential homebuyers. High-interest rates can discourage prospective buyers, while low rates can stimulate heightened real estate activity due to the reduced long-term cost of home financing.

- Economic Conditions- The overall health of the economy is a major determinant in forecasting the real estate market cycle. In periods of economic prosperity or growth, consumers are more inclined to invest in residential real estate, anticipating personal wealth accumulation and property value appreciation. A thriving economy often corresponds with a buoyant real estate market, while economic downturns tend to lead to a subdued real estate market.

These factors collectively shape the intricate and ever-changing landscape of the real estate market cycle, and their interplay plays a crucial role in determining market conditions at any given time.

Conclusion

In the ever-evolving real estate market, we diligently search for value-added opportunities, conducting thorough due diligence and employing a conservative underwriting approach that factors in potential risks and maintains a financial model with a margin of safety.

In today’s dynamic economic landscape, staying well-informed is imperative, with a focus on monitoring economic indicators such as inflation rates and interest rate fluctuations, as they significantly impact investment strategies.

If you’re eager to explore the current industry landscape and discuss your investment goals, please Get in Touch with us.

If you haven’t already, be the first to hear about our incredible offerings for passive investors by joining our Wealth Without Wall Street Investor Club. After you apply, you’ll receive tailored investment opportunities around living life on your terms.

-

Building a Multifamily Investment Team: Assembling Your A-Team

Building a Multifamily Investment Team: Assembling Your A-Team -

Understanding Multifamily Investment Returns: Cash Flow vs. Appreciation – A Deep Dive for Savvy Investors

Understanding Multifamily Investment Returns: Cash Flow vs. Appreciation – A Deep Dive for Savvy Investors -

What Returns Can You Expect as a Passive Real Estate Investor?

What Returns Can You Expect as a Passive Real Estate Investor? -

Why Multifamily Investments Outperform Single Family Homes

Why Multifamily Investments Outperform Single Family Homes -

Difference Between Commercial Real Estate Asset Management and Property Management

Difference Between Commercial Real Estate Asset Management and Property Management -

How To Achieve Financial Freedom in 2024

How To Achieve Financial Freedom in 2024 -

Exploring the Potential Upside in a Preferred Equity Real Estate Investment

Exploring the Potential Upside in a Preferred Equity Real Estate Investment -

Strategic Real Estate Investment: Overcoming Economic Downturns at Every Phase of the Market Cycle

Strategic Real Estate Investment: Overcoming Economic Downturns at Every Phase of the Market Cycle